How a leading Thai Bank increased profitability by reducing CPL and boosting CTR and CVR

Our client is a renowned banking corporation, and has established a comprehensive network of over a hundred mini-branches across Thailand. Positioning itself as a modern option for consumers in today's digital age to become a one-stop platform for all integrated financial and investment needs.

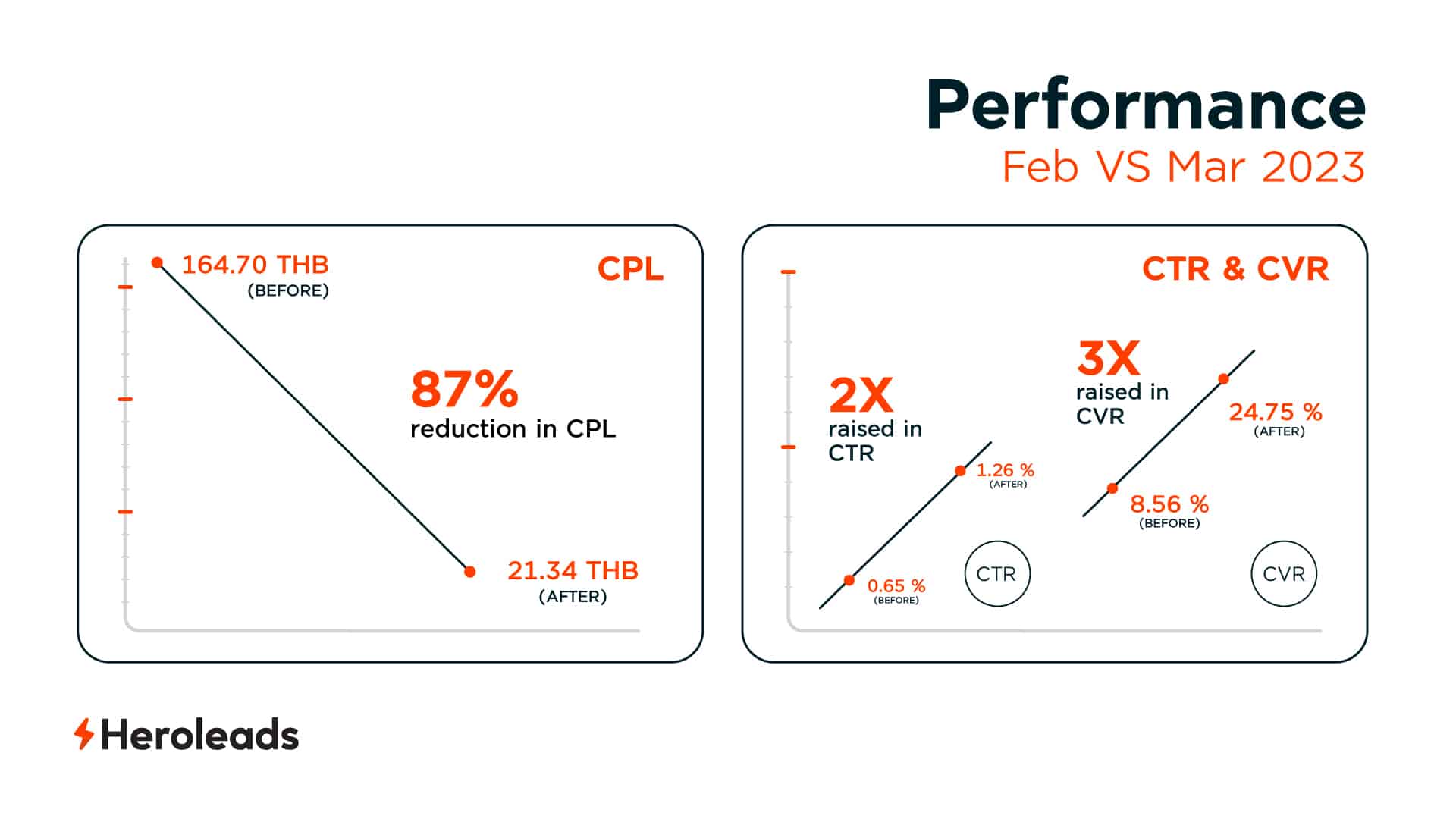

Outcomes

Within 6 months of partnering with Heroleads, we have seen remarkable success:

1) 87% reduction in CPL

2) CTR experienced a notable rise of 2X

3) CVR of the campaign 3X increase

Challenge

The COVID-19 pandemic has caused a great deal of upheaval and fluctuations in global capital markets. This has resulted in increased competition from shadow banks and new digital players. Our client's marketing team faced a challenge in maintaining the quality of leads and managing the rising costs of their campaigns. Additionally, our client has seen a gradual decrease in performance when attempting to cross-sell high-value products such as personal loans after the pandemic.

Our client was looking for a digital marketing expert to overcome their obstacles, with the goal of optimizing their digital marketing campaigns and developing an effective strategy to maximize key performance metrics. This included collaborating with the client's team to find the best solution, such as creating a better Landing Page, to lower CPLs and outperform their competition.

Approach

The strategy focused on two key components, highlighting the importance of their combined impact-

1) User Experience Optimization on Website: In order to enhance the current website structure, our team conducted an analysis of the client's old website template and found that the website's registration process required a few steps, which may not be suitable for the current situation. To improve the overall look of the website, our team identified various strategies, such as redesigning the banner and adjusting text, as well as implementing a new registration form that can be completed with one click. By doing so, our client was able to generate more quality leads and conversions. Furthermore, this approach allowed the client to get a clear call-to-action from visitors and collect valuable data about potential leads.

2) Enhance the Customer Journey by increasing Top of Funnel investments: Our team worked closely with customers to suggest investing more in their social media presence. As a result, the client's customers were able to engage with every aspect of the brand. In addition, it allowed for an increase in top-of-funnel spending to increase awareness and build a larger pipeline, which in turn leads to a lower CPL in the long run.

3) Personalization of Content towards Specific Audiences: Using Heroleads personalization marketing strategy, our client was able to build long-term customer relationships and retain customers by personalizing their content to a specific audience related to different types of customer information: demographic data, contextual data, and behavioral data. Moreover, Heroleads recommended our clients to focus on two primary techniques: personalized web pages and product recommendations. This process helped our clients to have a delightful effect on their customer experiences along with improving lead nurturing, more chances of conversion and higher revenue.

Are you looking to reach new heights with your financial institution?

Our digital marketing campaigns can help you develop a strategic plan and set you apart from the competition. Reach out to us to learn more about how we can help you maximize your success